DCA vs Grid vs Combo bots | Choosing the right strategy

Explore the nuances of grid and DCA bots in crypto trading. Discover how they operate, their effectiveness in varying markets, and the best fit for you.

Get more profit from your crypto with our trading tools

When it comes to crypto trading, staying updated with the latest tools is critical to developing an edge in the market. Two types of automated strategies have gained popularity among traders looking to maximize their potential: grid bots and DCA (Dollar-Cost Averaging) bots. These tools offer distinct approaches to profiting from the volatile crypto markets. This article will explore each bot type's pros and cons and ideal deployment scenarios.

Understanding Grid Bots#

How Do Grid Bots Work?#

Grid bots automatically execute buy orders at lower prices and sell orders at higher prices within a predefined range. The “grid” refers to a series of price levels within this range. As the market fluctuates, the bot buys low and sells high, aiming to profit from small price movements.

Grid Trading Strategies Types#

Grid trading is flexible. You can set:

- A narrow grid for low volatility

- A wide grid for volatile markets

- A super wide-range grid stack for long-term, low-maintenance trading

Each strategy can be fine-tuned with grid size, price range, and number of orders based on market outlook and risk tolerance.

Creating a Grid Bot: Step-by-Step#

For a video walkthrough, see the tutorial. Here's the summary:

- Coin Selection: Use a free crypto screener to filter coins by volatility, sentiment, volume, etc.

- Chart Analysis: Choose pairs with consistent oscillation. Avoid strong trends.

- Define the Range: Set upper/lower limits using support, resistance, and other tools.

- Grid Setup: Decide on the number of levels. More levels = more frequent trades but smaller profits. Use a grid bot backtester to test spacing.

- Investment Allocation: Set how much capital the bot should use.

- Automation: Launch the bot. It trades automatically within your range.

Grid bots automate emotionless trading and are popular for their precision and consistency.

Understanding DCA Bots#

What Is a DCA Bot?#

A DCA bot buys more tokens as prices drop by set percentages, lowering the average cost per token. Instead of lump-sum buys, DCA spreads entries across price levels. It’s useful in bear markets to avoid buying too early.

Dollar-Cost Averaging: A Deep Dive#

DCA has been used in traditional finance for decades. The crypto version is more dynamic, typically based on price triggers. For example, buy $100 every time price drops by 1%.

This avoids market timing and can be combined with time-based DCA using the double DCA strategy.

How DCA Bots Operate (Long Strategy Example)#

Say you're investing in Bitcoin with a DCA bot:

- Initial Investment: Buy $100 of BTC.

- Price Drop Trigger: If BTC drops 1%, buy another $100.

- Repeat: Continue for each 1% drop, lowering your average entry price.

Creating a DCA Bot: A Guide#

- Strategy Planning: Set how much to invest and the drop % that triggers a buy.

- Choose Your Cryptocurrency.

- Set Up the Bot: Define parameters and trigger logic.

- Monitoring and Adjustments: Review periodically and adjust if needed.

Comparing Grid Bots and DCA Bots#

Critical Differences Between Grid Bots and DCA Bots#

- Take-Profit Strategies: DCA uses one TP target for the whole position. Grid bots TP per trade.

- Profitability: DCA = bigger profits less often. Grid = small consistent profits.

- Risk Management: DCA reduces risk by spreading buys. Grid excels in sideways markets.

- Market Adaptation: DCA accumulates tokens; grid trades volatility.

- Ideal Market Conditions: DCA = downtrends. Grid = ranging/sideways markets.

Each has strengths based on market behavior and trader goals.

Which Is Better: Grid Bot or DCA Bot?#

- Grid bots are great for sideways or range-bound markets.

- DCA bots are best in downtrends, buying cheaper over time.

They both work well but serve different purposes. You can use one—or both—depending on your market outlook and how hands-on you want to be.

Combo Bots: Combining Grid and DCA Strategies#

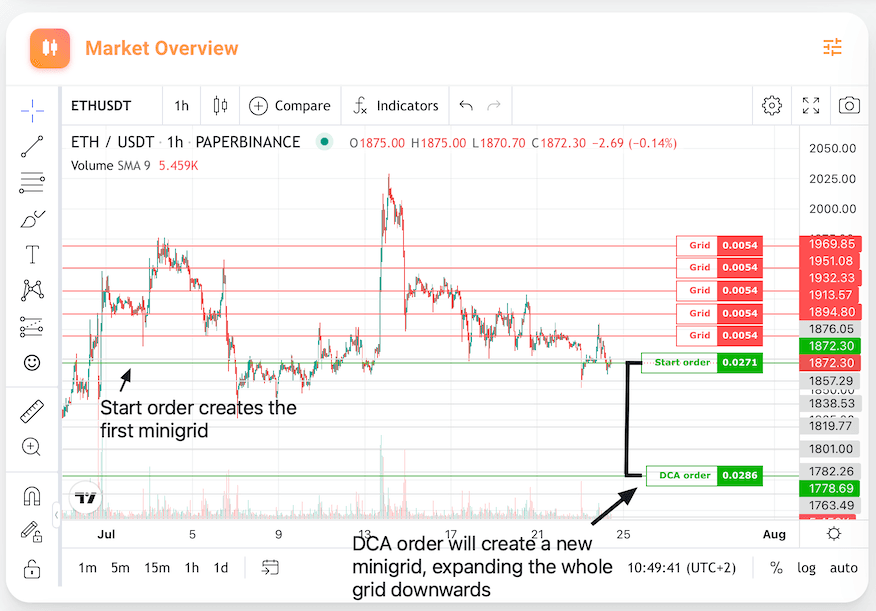

Combo bots fuse both strategies into one. They:

- Use DCA during downtrends

- Switch to grid trading when the market ranges

They function like DCA bots but add “minigrids” after each buy. Rather than selling the whole position at once, each DCA entry sets up a grid for smaller, profitable sells.

This tactic adds flexibility and increases profit opportunities.

To learn more, see Understanding the combo bot.

Key Differences Between Combo, Grid, and DCA Bots#

Combo bots automatically switch between grid and DCA based on rules and conditions. They can:

- Trade short-term moves with grid

- Build long-term positions with DCA

When to Use Combo Bots in Trading#

Combo bots are ideal for:

- Traders who want consistent profits and long-term accumulation

- Markets with changing volatility and trend behavior

Conclusion: Selecting the Right Bot for Your Trading Style#

Each bot serves a different purpose:

- Grid bots: Best for sideways markets and frequent trades.

- DCA bots: Ideal for downtrends and long-term accumulation.

- Combo bots: Flexible hybrid for both styles.

Choose based on your goals, risk tolerance, and how involved you want to be. Use the right tool for the job and the market you're facing.

The crypto market is volatile, but these bots give you an edge—whether you're growing holdings or looking for consistent gains.

Get more profit from your crypto with our trading tools

Get more profit from your crypto with our trading tools

About Ares Sanchez

• Captain of the ship at gainium.ioI am the founder of Ganium.io, a cryptocurrency bot platform. I'm also an avid meditator and fitness and health enthusiast. In my spare time, I like to code small utilities that do work for me, so I never have to work again. Despite being what some would call a "serial procrastinator", I have some unique talents that have served me well in life. For example, I can always put the USB-C connector in the right way on the first try, I'm an expert at picking things up with my toes, and I can move only one eye at will.